COINS FOR INVESTMENT?

Posted by RareBird on Aug 11th 2023

When considering the hobby of coin collecting the question inevitably arises as to whether coins can be considered a good investment. The answer is that as an asset category coins tend to appreciate in value. If the question is not answered in more detail then that answer may be misleading. Just as the stock market tends to go up or appreciate over time so do coins. But when looking at stocks as a whole one knows that not all stocks appreciate. Some do better than others and some (even thought they appreciate) do not keep up with some of the more respected metrics such as the DOW JONES, the S&P 500 or inflation. So what is the real answer?

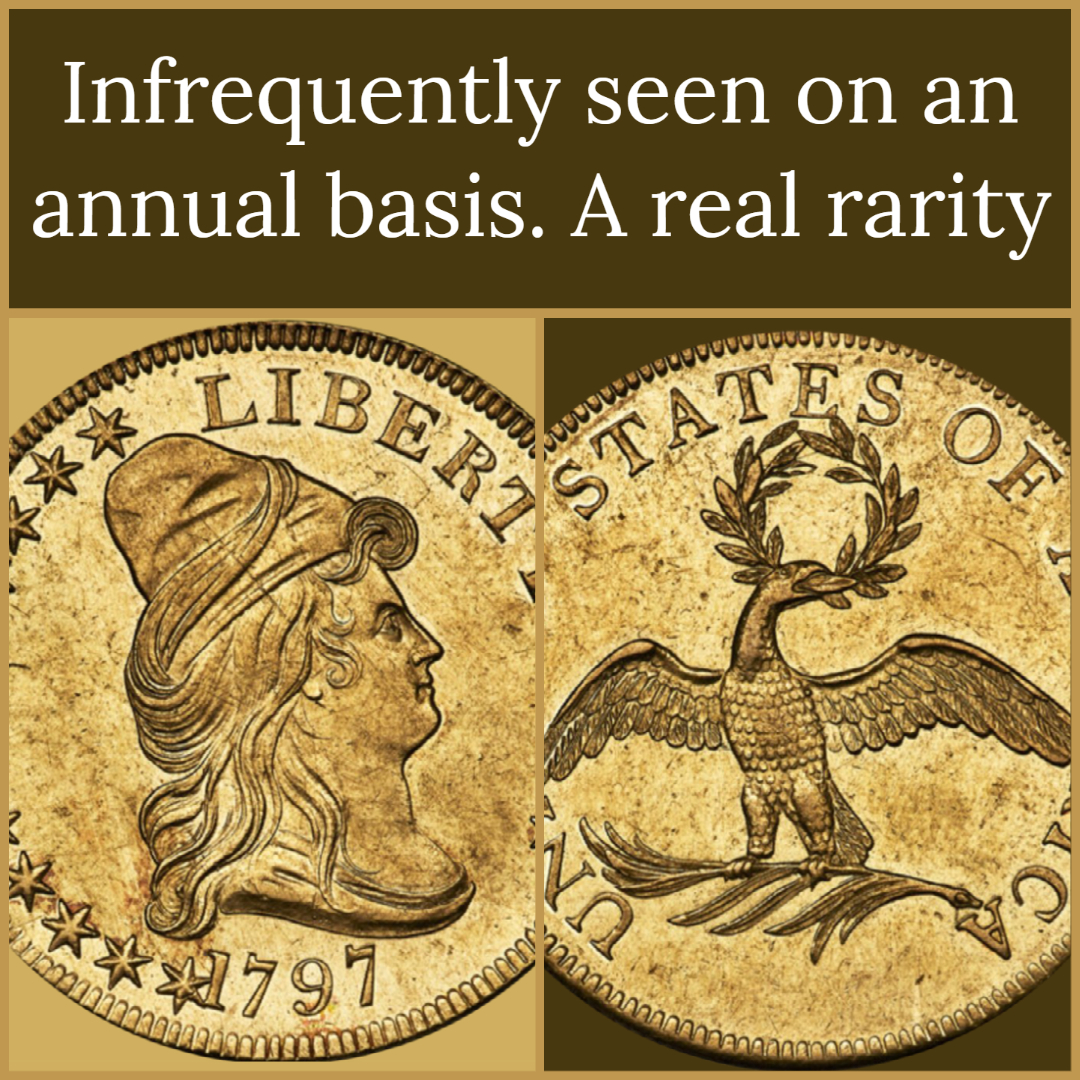

If you are looking for rapid annual appreciation then coins as an investment vehicle are not appropriate. Coins in the investment world are for diversification. You park money in coins as you would in real estate, fine art, fine wines, jewelry, cars and watches. All of the aforementioned will appreciate provided that care is taken to choose the individual asset wisely. Wrongly chosen real estate, art, wine, jewelry, car and watches will not yield the desired result. So some of you may be thinking..."this guy is talking to the rich and well healed investor". My answer would be no. Not necessarily. The key here is if you are going to undertake this task on your on you will need to have an additional asset. Money will not suffice. The second asset will consist of a love of coins. The best results are seen among collectors. They love what they collect so the time (another required asset) required to choose wisely is not seen as a laborious chore.

Car collectors, wine collectors, art collectors, watch collectors, jewelry collectors and yes... real estate collectors. All the best performers are passionate about the items they collect. The best purchases are researched for rarity, uniqueness and maybe a special story or provenance that adds fire to the quality of the item being purchased. Then financial resources are gathered so that a competitive bid may be placed. This is occasionally added to by spending a little more than one might have originally wanted to allocate. Yes. A little over reaching may be in order. It make you feel a little uncomfortable, a little nervous. This behavior culminates in the best and most rewarding purchases.

John J. Pittman did it. Mr. Pittman, an engineer for Kodak reportedly mortgaged his house in order to fly to Egypt and attend the King Farouk coin auction. No this is not a mad as it may sound. The Farouk auction by all accounts was a fire sale that was poorly attended. So, as stated earlier research and risk taking counts. Hind site makes this look like a sure thing but think about flying off to a country where you don't speak the language. Add to this taking a large amount of money (on average $100,000.00; approximately $5,000,000.00 in todays money) overseas. The word uncomfortable takes on new meaning.

So this is the way the game is played? Yes, and knowledge is power. So you will hear the phrase, if you ask, "Buy the book before you buy the coin". Most will not. Most will learn, if they learn, by financial trial and error. When you look at your early purchases and compare them to later purchases (that are more informed) then you will understand the reason for the book-first advice. Later blogs will discuss my journey and my strategy. Formulas for success? Yes. But...no magic formulas.